A Journey from Itta Bena, Mississippi

Itta Bena, Mississippi is likely not on your bucket list of places to visit. Even so, our journey to understand currency hedging starts in this small town of approximately 2000 people. The “King of the Blues” music genre, the late great B.B. King, was born near Itta Bena in 1925. He passed away in 2015. Perhaps his most famous tune was “The Thrill is Gone.” It is worth a listen if you have not heard it.

For those that have never really heard of B.B. King, he is one of the giants of American musical history. The blues are a truly unique form of music, uniquely American, that provide an incredible human element, often a melancholy feel, and originated in the deep South with African American artists. It is a musical form that is emotive and often has stories of personal woes, harsh realities of the South during a difficult period in US history, and often lost loves. Blues music stirs the soul.

As a new father, I have become quite reflective on my own childhood. My late father used to have a collection of albums and play music on a record player like this. When I prepared to write this newsletter about currency hedging and the last real estate cycle of Brazil, I thought of the words of B.B King’s song that I heard playing as a kid.

As a new father, I have become quite reflective on my own childhood. My late father used to have a collection of albums and play music on a record player like this. When I prepared to write this newsletter about currency hedging and the last real estate cycle of Brazil, I thought of the words of B.B King’s song that I heard playing as a kid.

“The Thrill is Gone, The Thrill is Gone Away” pretty much summed up the emotion that I heard from some investors that invested earlier in the real estate cycle, unhedged.

The Purpose of This Newsletter

This newsletter’s objective is to provide context for currency hedging for deep value investors. The newsletter’s focus is on investors who measure their investment returns in USD. While we will not determine whether an investor should or should not hedge the Brazilian currency, this is an investor decision, we will provide context and case study to provide a framework for that decision. Importantly, we will cover “The Thrill” period of often unhedged USD investments in Brazil from 2009 to 2012. As we finish, we will begin to dig into the mechanics and costs of hedging the currency. Importantly, we will look at the current fiscal, economic, and political environment and provide a perspective about the currency risks going forward. Special thanks to our strategic partners at VNCFX who have worked with us to provide cost efficient hedging strategies for deep value investors. Please click here if interested to receive more information about currency hedging. As this is fairly detailed, feel free to grab a cup of coffee (I am about to get one myself actually!). As always, I will work to keep it interesting.

Quick note, per this and our last newsletter on Why Politics Is Important for Emerging Market Investors, InDev provides unique custom information services for interested investors via our premium newsletter and research products to facilitate deep value investing in Brazil. However, for now let’s get back to our Hero from Itta Bena….

“The Thrill is Gone.. The Thrill is Gone Away”

Rolling Stone Magazine ranks “The Thrill is Gone” as one of the 500 greatest songs of all time. The song is a story about a “wronged man’s” heartbroken rage which over time during the song becomes a “vengeful chill.”

Rolling Stone Magazine ranks “The Thrill is Gone” as one of the 500 greatest songs of all time. The song is a story about a “wronged man’s” heartbroken rage which over time during the song becomes a “vengeful chill.”

When it comes to bad experiences, particularly those based on currency losses, there are likely some “vengeful chills” out there among investors in Brazil earlier in the real estate cycle (unhedged bets in 2009 to 2012 period).

As always, particularly for deep value investors, “It is all about the price you pay.” The entry price more than anything else determines the risk and the size of your potential gains. In deep value emerging market real estate investing, some “vengeful chills” can occur by not paying attention to currency, not hedging, or a combination of both.

Three Simple Charts: BRL to USD Exchange Rate, GDP Growth Rate, Budget Deficit

Let’s study three charts individually and then collectively to get some clarity around the currency issue. It is quite a story and quite an opportunity.

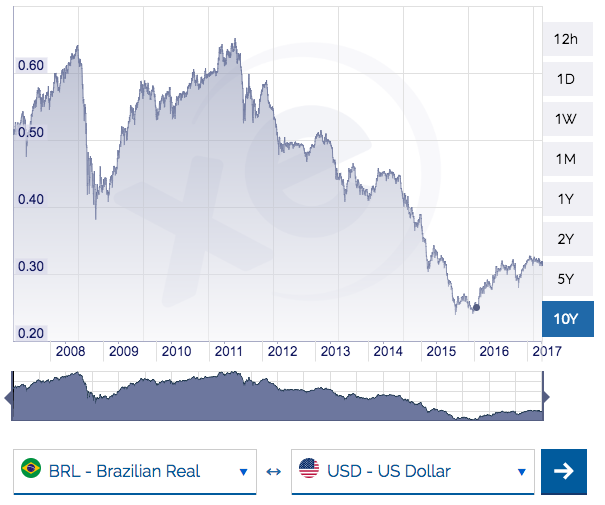

Brazil Real to United States Dollar Exchange Rate

(Source: https://www.xe.com/currencycharts/?from=BRL&to=USD&view=10Y)

This chart shows the strength of the Brazilian Real relative to the USD over the past ten years. Along with significant volatility, after approximately October 2011 which was the peak, we see a general downward direction to a bottom around January in 2016. Why? Quickly, Brazil greatly benefited from structural reforms executed under President Cardoso from 1995 to 2003. These reforms included the consolidation of price stability, which started in the Itamar Franco mandate when Mr. Cardoso was Finance Minister, the then new Brazilian real being overvalued to control hyper inflation, an increase in the basic interest rate, creation and increase of taxes, cut of public expenses and increased incentives to investors, and approval of constitutional amendments that facilitated the entry of foreign companies in the country.

Moreover, President Lula, much to almost everyone’s surprise, continued the three stool policy of a low inflation target, free exchange rate, and budget surplus, especially during his first term of 2003 to 2007. These structural reforms, a commodity supercycle with high exports to China, a low global interest rate environment which created a global search for yield, and Brazil’s relative political stability created a perfect storm for the currency from 2008 to around 2011. With the brief exception of the global financial crisis, 2009 to 2012 was the “Thrill” period.

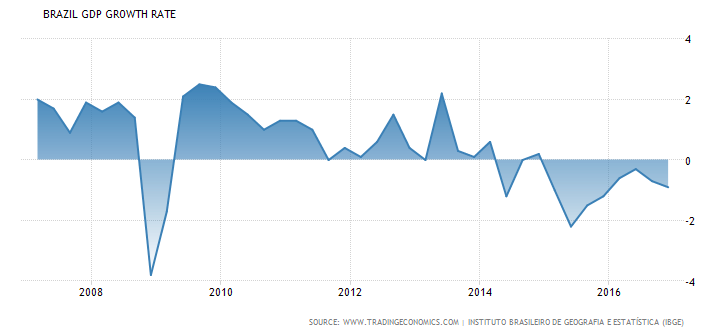

Brazil GDP Growth Rate

(Source: http://www.tradingeconomics.com/brazil/gdp-growth)

With the clear exception of the global financial crisis, we see relative positive numbers in Brazil’s GDP growth. However, Brazil’s government policies started to shift after the global financial crisis. In particular, government spending expanded greatly. In addition, while growth continued there was a tremendous amount of government direct intervention in an effort to pick winners. This was done through a two-tier banking system in Brazil, BNDES, which lent money to some firms below the actual cost of that capital and commercial banks that loaned money at market rates. This interventionist tendency was a meaningful part of the growth in 2013 and 2014. When the government could no longer execute this interventionist strategy in 2015, things got very ugly very fast.

Budget Deficit as a Percentage of GNP

(Source: http://www.tradingeconomics.com/brazil/government-budget)

The above budget deficit graph is an important backdrop to what happened, what is happening now, and a large part of the investment thesis to purchase existing assets with high yield to costs that InDev has outlined in several newsletters (June 2016 NL, November 2016 NL).

There is a great quote attributed to Winston Churchill about the USA that provides a perspective on the above graph. “The Americans can always be trusted to do the right thing, once all other possibilities have been exhausted.” If we use the same quote about Brazil, it could be said, “Brazilians can always be trusted to do the right thing, once all other possibilities have been exhausted, and they have waited until the absolute last possible moment.”

There is a great quote attributed to Winston Churchill about the USA that provides a perspective on the above graph. “The Americans can always be trusted to do the right thing, once all other possibilities have been exhausted.” If we use the same quote about Brazil, it could be said, “Brazilians can always be trusted to do the right thing, once all other possibilities have been exhausted, and they have waited until the absolute last possible moment.”

In reality, Brazil’s spending pattern was not sustainable. This has been a key driver of the currency weakness. In addition, this was a critical factor in Brazil losing its hard fought investment grade status on September 9, 2015. The current structural reforms that President Michel Temer, the most under appreciated reformer this writer knows, is implementing should provide a floor to the currency going forward. We cover these reforms in our most recent newsletter and since that newsletter two weeks ago additional reforms have moved forward. This potential floor to the currency assumes that there are no political surprises in next year’s elections.

Putting it all Together

There is no way around the fact that an investor who invested in July 2011 and sold in January 2016 unhedged would have every reason to go listen to melancholy music and sing their own version of the blues. In fact, just to break even on currency at the project level during that period would require IRR returns of 23.29%.

There is no way around the fact that an investor who invested in July 2011 and sold in January 2016 unhedged would have every reason to go listen to melancholy music and sing their own version of the blues. In fact, just to break even on currency at the project level during that period would require IRR returns of 23.29%.

However, looking at the three graphs currently, it is pretty hard to deny that the downside risks look significantly smaller than the upside risks. From a deep value investor’s perspective, with an attractive purchase price, based on the likely interest rate reductions that are already occurring, Brazil perhaps even unhedged makes sense.

I will not nor can I make that decision for you. But just in case something happens that we cannot predict (some strange election result, China somehow finding a way to grow soybeans, etc.), currency hedging is an option and not a bad one. Emerging markets are emerging markets for a reason: there is higher risk.

Let’s pretend that the reader is a “Thrill is Gone” USD investor and desires to reduce the currency risk. What can one do and how?

Quick Aside

Once again, I am writing this newsletter at 4:30 am. I am off to get a coffee….. OK, I am back. Thank goodness for that not so famous goat herder, Kaldi, who legend has it discovered coffee in Ethiopia in the 9th century when he noticed how excited his goats became after eating the beans from a coffee plant. I digress, back to currency hedging. My apologies.

Currency Hedging Case Study – Questions to Understand

Hedging costs are usually driven by the interest rate difference in two countries. As Brazil has high relative interest rates, the cost of hedging is higher than in other markets. If it were cheap to short the Brazilian Real, investors could convert USD to Brazilian Real, put money in the bank in Brazil for a short period, and convert the money back to USD and make money off of the interest rate spread. So to be clear, hedging the Brazilian real is not cheap and is only justifiable as the returns on certain investments relative to their risk can make hedging worth the effort. Let’s dig in.

Here are the investor assumptions: one, totally USD return and equity multiple focused; two, while not desiring to go into the currency trading business, open to understand the nuances of risk and reward in currency hedging; three, investing in Brazil because of the thesis outlined in this and previous newsletters but desires to lower downside risks.

- Project – Income Producing Logistics Asset

- Reason for Sale – Liquidity / etc. (value-based acquisition)

- Investment Thesis – Purchasing Assets with Rent Below Market and/or long-term fixed rental contracts indexed to inflation, Cap Rate Compression, as Rapid an Exit as Prudent

- Objective – Buy Low Sell High

- Leverage or No leverage – No Leverage – reason will become clear later

- FX Rate US$1 = BRL$3.18

- Purchase Yield to Costs – 10.5%

- Income per year in USD $10M BRL$31.8M

- Purchase Price USD $95.24M BRL$302.87M

- Purchase Date July 1, 2017

- Sale Date July 1, 2020

Hedging Strategy

As with any strategy there are choices and preferences. Importantly in hedging the Brazilian Real, a lot depends on the investor risk tolerance. There are multiple strategies (please email me for a more detailed discussion about hedging strategies); however in this newsletter we will cover two select strategies in detail: one, an “at the money” call strategy, which provides maximum protection above a certain level of depreciation but has a higher upfront cost; two, a “put up a fence” combination of simultaneous put and call strategy, which has a much lower initial cost but does have a cost if the Brazilian currency actually strengthens against the USD. Let’s continue our journey to understand further.

Strategy #1 “At the Money” Call Strategy – High Quality Night’s Sleep – 5 Star Hotel Mattress – Those huge fluffy pillows etc…

The investor goal is to sell the asset in three years. However, a three-year hedge done in local Brazilian currency could require up to 25% to 30% of the principal investment. This would have a very significant impact on investors IRRs. Not small potatoes at all. A more viable strategy is to hedge for 12 months at a predefined level. Importantly, the cost of the hedge is directly proportional to the level or the tightness of your protection For example, at the time of this writing the BRL to USD exchange rate was BRL 3.18 to USD1. To hedge for twelve months such that the investor is covered for any depreciation above BRL 3.39 to USD 1 would cost 8% of principal. I think your coffee just spilled…. My apologies….This is expensive because this call is in the money with an only 6.7% currency move in the wrong direction which is not beyond the range of possibility. It is arguable that this price may be extreme for protection in such a small movement in currency.

On the other side of the spectrum, an investor can purchase a twelve-month hedge and be protected for any currency depreciation above BRL 3.75 to USD 1 for 4.5% of principal balance. This is an 18% movement which would be quite significant. This is cheaper as the likelihood of the call being in the money is much less.

So what does this do for the investor? If the investor for some reason(s) wants to be able to sell the asset within the first year and protect their principal, they are fully protected at the level of the spot price. These costs must be overlayed with the “Sleep at Night” factor. It may be important to always know where you are on a USD basis as this helps an investor protect their downside. Now, given that the probability of selling the asset is low in year one, this “High Quality Sleep at Night” factor is the driving decision in executing a year one and/or multi-year principal “at the money” call hedging strategy.

Importantly, as we mentioned the asset produces income of 10.5% a year and Brazil has fixed income devices that can generate quite healthy nominal returns, the BRL31.8M in rental income serves as a somewhat natural hedge. First it can be used to return the cost of the initial hedging costs and annual hedging costs if the investor chooses. Secondly, if the capital stays in Brazil, it can be invested in a fixed income instrument such as local treasury bonds linked to inflation, CD style bank deposits which if locked in soon can provide up to 10% annualized returns with almost no risk in local Brazilian currency. This capital build up can generate a very nice natural hedge to produce a good night’s sleep.

Importantly this “at the money call strategy, over time, can be a way to start to lock in gains as an investor gets closer to exit. Again, we work with specialists on this matter and welcome a conversation to dig in further. This can be a very viable strategy and the costs can be minimized, but it does require a strategy.

Strategy #2 – “Build a Fence” Call Put Strategy – Good Night’s Sleep – 3 Star Hotel Mattress – Nice pillows, not quite as large or fluffy…

For investors that find the initial up-front costs of “at the money” call hedging prohibitive, a much lower cost option is a “put up a fence strategy” with a call and a put strategy within a given range of movement. The fence keeps things under control in a given range of currency variation. This protects the investor within that range. For example, an investor could have a call option at BRL 3.6 to USD1 and a put option at BRL 3.38 to USD1. In this situation, if the currency weakens above BRL 3.6 the investor is protected. However, if the currency strengthens and correspondingly the dollar weakens there will be a deposit requirement to cover the put. However, if the dollar is weakening, your asset (and the income from that asset) is much more valuable so, at the asset level, the investment is increasing.

This strategy is interesting in an income producing property because the income of the asset is increasing in value if things go the wrong direction. Hence, this income can be used to cover at least a portion of the additional payment necessary on the put if the BRL strengthens. Alas, this is why our case study of an income producing asset is so relevant.

The ranges of this type of “put up a fence” put call strategy are flexible and the costs obviously vary based on the range. This can be a very interesting strategy and in order to provide more details, an investor would have to determine the range of the call put that they required.

“The Thrill is Gone” A Summary

Well, we traveled all the way from Itta Bena, Mississippi (pop. 2000) to Sao Paulo, Brazil (pop. 12,000,000). Thanks for reading and traveling with me as always. The currency environment in Brazil appears to be favorable at this time with likely more upside than downside risk in the medium term or, at least, the likelihood of the catastrophic losses similar to those seen during the thrill period do not appear to be probable.

This newsletter’s objective was to cover a very tough topic and there are a lot of details and math behind this analysis. As stated earlier, for investors that want to dig into more detail we offer a premium newsletter product that really digs into these complex issues of Politics and Currency hedging in great detail.

If you would like to have another discussion or have access to our currency hedging White Paper – “Mattress Quality and Currency Hedging – A Sleeper’s Guide: A Detailed Analysis of Hedging the Brazilian Real for Income Producing Investments” please shoot me an email at joseph.williams@indevcapital.com.

Have a great weekend… until 4:30 am two weeks from now.

Warm Regards,

Joseph

CEO & Founder InDev Capital