“In investing, what is comfortable is rarely profitable”

– Robert Arnott

There are several smart investors looking for “distressed” opportunities in Brazil. Blackstone’s recent purchase represents such an investment. BRE Ponte Participações, the Brazilian private equity investment vehicle of Blackstone, purchased ten real estate assets for R$1.065 B ($300M+) from BR Properties, a publicly traded developer, manager, and acquirer of properties in Brazil. Brookfield, a global alternative asset manager, also purchased an additional R$2.1B ($600M+) from the same seller.

Along with this macro commercial property investment theme that we discussed in our previous newsletter, perhaps another way to look at investment opportunities in São Paulo is to understand how the new master plan (zoning) will affect local supply and demand dynamics, as well as the real estate product offerings in different sub-sectors of the city.

The new São Paulo urban master plan attempts to correct this problem and the implications are important for investors to understand, as they may create attractive investment opportunities with the right local sponsor as a co-investor.

The New Master Plan of the City of São Paulo

In 2014, the Sāo Paulo city officials put forth a new master plan for the city for the next 16 years.

The São Paulo Master plan has the following stated objectives:

- Maximize population density along public transportation corridors & reduce the size of buildings in the rest of the city.

- Incentivize public & other non-motorized methods of transportation.

- Decrease the average commute (time & distance) traveled by the average citizen.

- Create a more social and equitable use of the city via social welfare programs, green spaces, community centers, and public areas.

The New Master Plan divides properties within the city into two distinct groups:

I. Public Transportation Corridors & Subway / Train Stations

Defined as areas within a 400 meter (1312 ft.) radius from metro & train stations, as well as city blocks that are within a range of 150 meters (492 ft.) on each side of public transportation corridor bus lanes. These areas represent roughly 20% of the city.There are significant incentives for mixed-use high-rise developments with public spaces on the ground floor.

Zoning Criteria Regulations

a) High Density: In these corridor & subway station areas, the developer is guaranteed the right to build a base scenario of 1x the total land area. The developer can purchase additional air rights to construct up to 4x the land area, with no height restrictions. Revenues from these air rights will be directed towards urban social improvements as shown in the chart below.

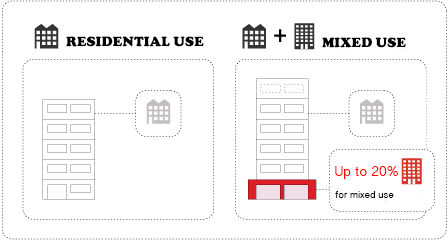

b) Incentive for mixed-use projects:

When designated for retail, services and other socially engaging activities, up to 20% of the construction potential can be designated for this use, which does not reduce the total construction potential from the total account.

Ex. On a land site measuring 1000m2, with a construction potential of 4000m2, up to 800m2 (20%) can be developed for mixed-use without subtracting constructive potential from residential development. Therefore, the total construction potential equals 4800m2, with 4000m2 for residential and 800m2 for mixed-use.

c) Incentive for more open & public spaces: Sidewalks will need to be widened and upgraded to match the style of the new buildings. They are to measure 3 to 5 meters (10 to 16 ft.) in width to cater to retail space on the ground level.

d) Limits on the number of parking spots: The first spot for each unit won’t be accounted for in the “total construction area”, but any additional spots will consume potential construction that could have otherwise been used for residential units.

e) Limitation of land per unit: this induces no greater than 80m²/unit (860 sq.ft/unit), on average.

How these rules will affect pricing on new developments

Within public transportation corridors, the new Master Plan encourages construction and does not limit construction heights. As a result, competition between developers to acquire land sites within these areas will increase dramatically. Considering these market dynamics, land owners will notice high demand for their lands and will require a higher price. Also, because of the high demand, air rights payments will increase. The market predicts that the prices of units for the final buyer is expected to rise by 5%.¹

II. Non-transportation corridors

This area represents all areas that are not included in the previous group. These areas make up roughly 80% of the city area.

Zoning Criteria & Regulations

a) Height restrictions: There is a new restriction of height in these areas of 28m (92 ft.), which is equal to eight floors in addition to a ground floor. While this may sound restrictive, the regulation will not be applied on blocks where 50% of the area is already occupied with buildings that exceed this limit. According to experts, the actual area which will be affected represents roughly 15% of the total.

b) Low density: Besides the base scenario, the total additional construction potential will be only up to 2x the land area (compared to 4x in transportation corridors).

How these rules will affect pricing on new developments:

In the non-corridors, the prices of residential units will also increase, similar to the corridors, but for different reasons. Besides the higher price of land, due to the expected increased value of the payment for additional air rights (“Outorga Onerosa”) of 40%,² the new Master Plan is so restrictive in terms of construction in the non-corridors and therefore new developments will be limited. As the demand remains high, the supply in the market may not be sufficient. For these reasons, experts expect to see an increase in unit prices of up to 15% in the non-transportation corridors.¹

Potential Opportunities to Invest:

According to the experts, considering the already approved projects in the City Hall, the effects of the new zoning will only be felt from 2016 onwards. However, we already find that smart local capital is looking at the following strategies.

Expectation for future launches – Focus on transportation corridors (CDB Area)

Land parcels located within the central transportation corridors in the expanded city-center (CDB) will be in high demand as they are more profitable. It is expected that project launches will decrease in the non-transportation corridors due to a combination of construction restrictions as well as steep incentives to develop elsewhere.

Existing assets whose attributes will not be able to replicate under the new Master Plan:

In the non-transportation corridors, existing high-rise developments represent an asset class with a high potential to maintain value. Additionally, existing developments within public transportation corridors that have multiple parking spaces per unit are also expected to retain value, as they will not be able to be replicated under the regulations of the new Master Plan.

If you have an interest in learning more about this or other opportunities to invest with top-tier local sponsors, feel free to reach out.

We look forward to hearing from you.

Best Regards,

Joseph Williams

President & CEO

InDev Capital

¹ SECOVI source at http://exame.abril.com.br/seu-dinheiro/noticias/preco-dos-imoveis-em-sp-tende-a-subir-com-plano-diretor

² Credit Suisse source at http://www.laramma.com.br/noticias/preco-dos-imoveis-em-sp-tende-subir-com-plano-diretor.html